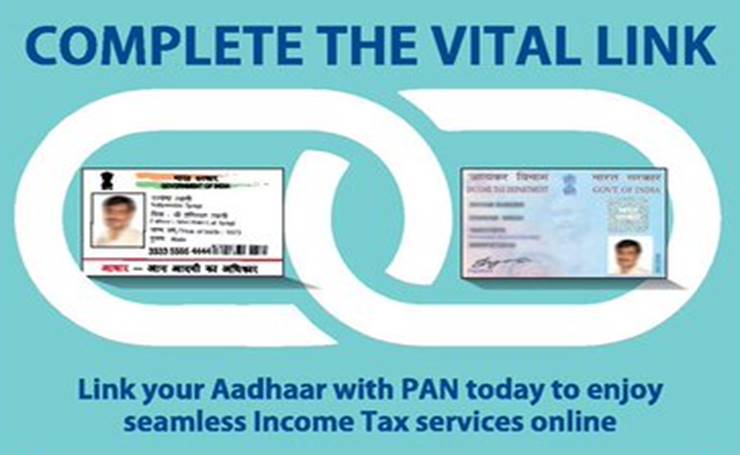

The last date to link your PAN with AADHAAR is March 31. If you are a NPS subscriber then you should link your PAN with AADHAAR before March 31.

The Pension Fund Regulatory and Development Authority (PFRDA) has given recent guidelines that NPS subscribers must link their PAN with AADHAAR to avoid any restrictions in their transactions.

The pension regulatory body said that PAN is one of the key identification numbers to know your customer (KYC) for the NPS accounts. According to the Income Tax Provisions linking PAN with AADHAAR is mandatory, failing which PAN card becomes useless after March 31.

The latest circular of the Central Board of Direct Taxes (CBDT) also states about Aadhaar-PAN linking by March 31. The defaulters will face all consequences under the Income Tax Act 1961 for not furnishing their Permanent Account Number.

How to Check whether your PAN is Linked with AADHAAR

- Go to the official website of Income Tax Department : https://www.incometax.gov.in/iec/foportal/

- From the Quick Links section Click on Link AADHAAR status.

- Then enter your PAN card and AADHAAR card number and then on “View Link AADHAAR Status”.

- You will get the message whether these are linked or not.

How to Link PAN with AADHAAR

- Go to the official website of Income Tax Department : https://www.incometax.gov.in/iec/foportal/

- From the Quick Links section Click on Link AADHAAR.

- Then enter your PAN card and AADHAAR card number and then on the “Validate” link.

- You need to enter PAN, AADHAAR, & Mobile Number.

- You need to pay and verify the penalty payment.

- An OTP will be sent to your mobile number.

- The PAN AADHAAR linking request is successfully submitted.

If you don’t link your PAN with Aadhaar, you will not be able to file your income tax return, and your PAN card will become useless.